May 2020

Inspire investor confidence with a compelling business story

As we draw closer to the end of this financial year, listed companies across Australia will be turning their minds to the upcoming reporting season.

Unlike previous years (or decades for that matter), this year’s results communications will be very different for one profound reason – Covid-19. The unprecedented disruption caused to economies and businesses across the globe by this pandemic means, more than ever before, companies will need to engage their audiences in a much more compelling way to reassure and build confidence.

As we emerge from this disruption, many companies will face more intense competition for investment. Apprehensive investors who may have seen the value of their investments decline, will be drawn to companies who have a well-articulated business story — one that resonates, builds understanding and trust and inspires confidence in the future.

Potent business stories go beyond pure performance

There are many reasons why investors choose one company over another. For many, sustained financial performance, dividends and capital growth drive their choices. However, there are many investors who look beyond pure financial performance to delve deeper into a business to inform their decisions.

Those companies who aim to deepen their engagement with their audiences, particularly during these uncertain times, should use this year’s reporting to address 3 key questions:

1

What perceptions does your company need to address?

2

How should people value your company?

3

Why should people value in your company?

To help answer these questions, more insightful explanation of a company’s position is needed. A more compelling business story starts with consideration to reporting on other business fundamentals including:

Does your business model and strategy maximise competitive advantage?

How well do investors understand your business? Business models and strategy are often complex and difficult to explain. Is there a clear strategic plan and how is its execution being measured? To avoid misunderstanding, a well-articulated business story should easily and simply explain these business fundamentals.

What’s the role of non-financial indicators?

Companies that do not provide non-financial indicators leave investors and analysts to make their own deductions usually resulting in undervaluation. A balance of financial and non-financial indicators helps investors build a more complete picture of a company’s value.

Outlook and growth prospects

A key question on investor’s minds will be “what is the business outlook particularly as we emerge from the current disruption” and how will the company grow”? Responding to these questions will require careful and considered explanation underpinned by business measures and key sector metrics.

Measuring management’s performance

Management’s credibility and leadership performance are always under scrutiny. In these unprecedented times, more intense focus will be on how well management is responding to key issues like risk. To help investors gain deeper insight into a company’s ability to emerge strongly from this crisis, the annual report should address human capital issues specifically around corporate culture and the employee proposition.

ESG reporting matters

With a growing focus on environmental, social and governance (ESG) issues, a communications gap has emerged between companies and shareholders over the information being reported. Investors are looking for standardised, rigorous data to help make decisions. However, many companies are releasing inconsistent or insufficient information often in a form that investors find difficult to understand.

Reporting ESG matters is critical to building a complete understanding of a company’s risk profile. More importantly, it also conveys how well prepared a business is for the future. As investors put more emphasis on ESG questions, companies with risk management practices that take into consideration broader industry, regulatory and societal risks, are more likely to drive sustainable performance and shareholder value over the long term.

How can

Collier help?

Be clear, more distinctive and differentiate

Before embarking on the development of your FY19 results communications, Collier Creative will undertake a peer group analysis to expose differentiation opportunities. Developing a compelling business story that stands out is critical to building awareness and understanding of your unique strengths and attributes.

Bringing a story to life

Whilst some companies see their reporting communications as a low-key compliance obligation, others see it as a great opportunity to connect and engage their shareholders. A small investment in good story telling and creative thinking can transform the report and results presentation into a potent communications tool. This will be particularly important in a year that has experienced the greatest disruption to people, business and investor confidence since the The Great Depression.

Aim

Clarity of purpose, target audiences and business outcomes

Idea

Consistency of branding and creative direction

Experience

Integrity & relevance of personal brand experiences

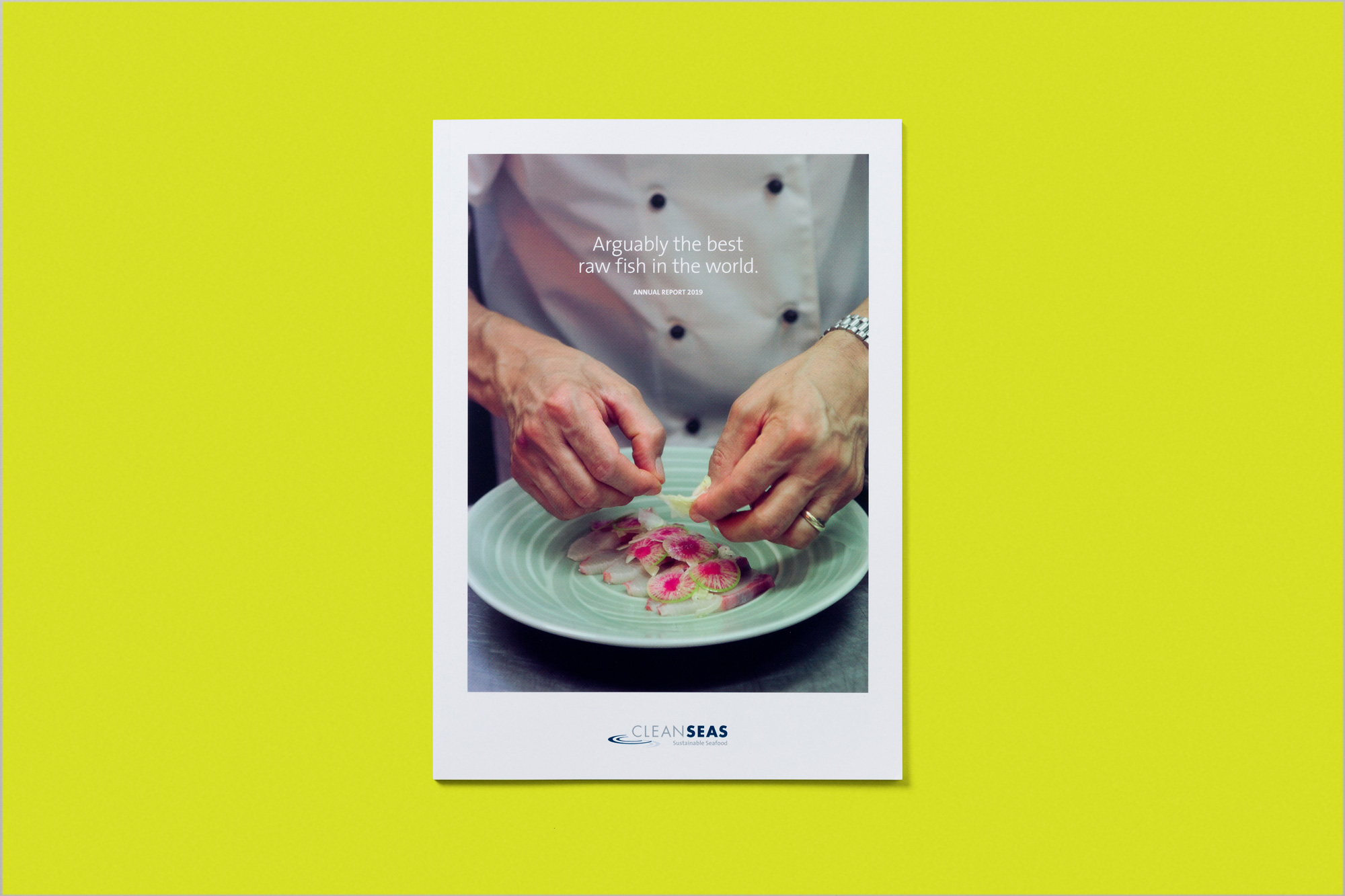

Clean Seas

Fresh market update whets investor appetite